The IRS withholding rate applied to self-employed workers will fall from 25% to 23%, for green receipts issued in 2025. In addition, payments on account will also suffer a reduction, according to the measures foreseen in the State Budget for 2025 (OE2025).

Currently, the withholding rate for self-employed workers is fixed, regardless of the value of the receipt issued or the existence of dependents or a second holder in the household. This reality differs from salaried workers, whose retention rate is adjusted based on income and family profile.

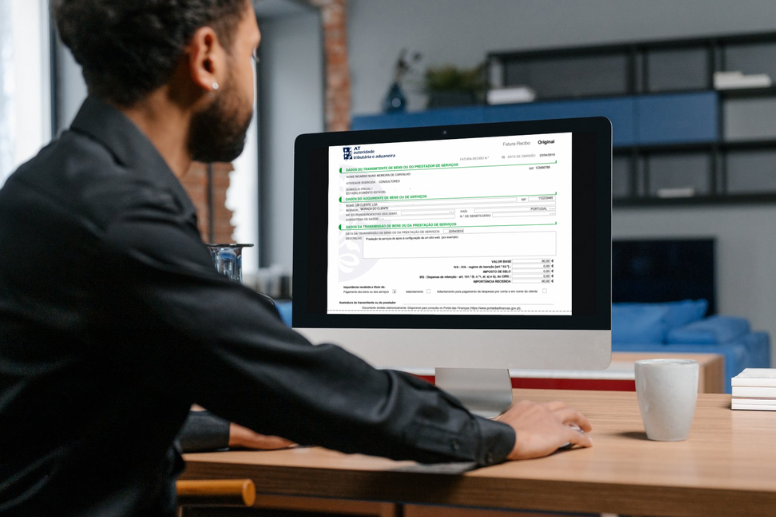

Until now, most self-employed workers faced a 25% rate, which will be reduced by two percentage points next year. According to OE2025, only professionals whose income reaches a certain amount in the previous year, or exceeds it in the current year, are required to make withholding tax. In 2023, this limit was 13,500 euros, rising to 14,500 euros in 2024 and to 15,000 euros in 2025.

According to , another new feature of OE2025 is the reduction in payments on account. Currently set at 76.5% of an amount calculated based on income from the second to last year, they are now 65%. These payments, made by independent workers such as doctors, lawyers, architects or economists, occur annually in three installments: July, September and December.

With these changes, the Government intends to alleviate the tax burden on green receipt workers, providing a greater balance between taxation and the income actually earned. The changes, therefore, adapt to the needs of this professional group, which has demanded greater flexibility in the tax system.

Also read: