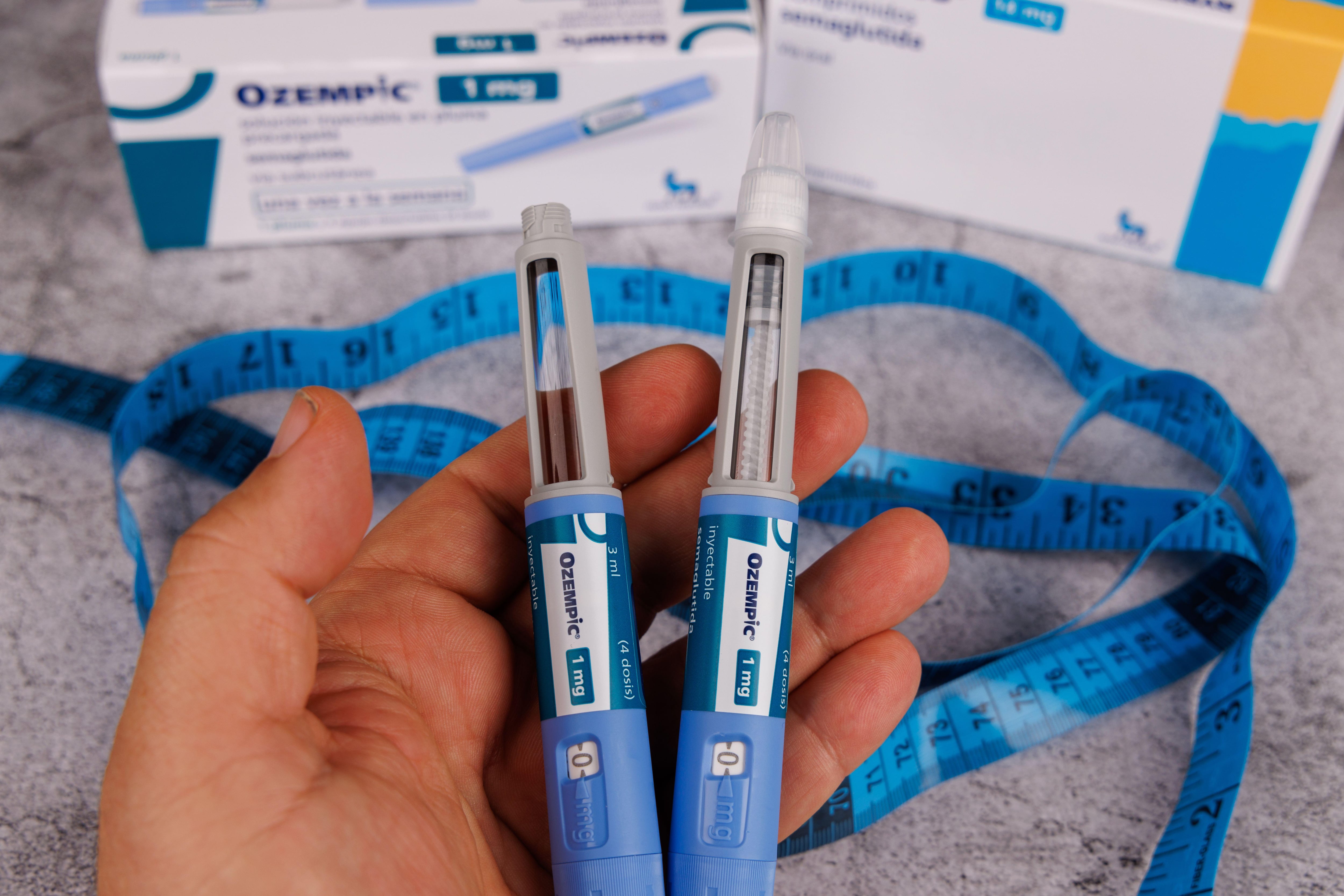

Sustaining long-term effects is often the most difficult goal for those trying to lose weight. Novo Nordisk, the Danish laboratory that in 2018 presented Ozempic, the injectable that revolutionized the fight against obesity, faces the same challenge. Seven years later, with a stock market capitalization of $382 billion that places it as the largest in Europe, this pharmaceutical company faces the challenge of staying in shape in a segment that, although it has led, is now full of new competitors.

The pressure against Novo Nordisk redoubled last December. The results of a phase three clinical trial – an advanced stage of research – for its experimental drug Cagrisema raised alarm bells: treated patients experienced an average reduction of 22.7% in their body weight after 68 weeks of treatment. The market interpreted this data as betting that this new composition – which adds Carigilintide, a hormone that improves the feeling of satiety and regulates food intake – would be the great evolution after its great successes (Wegovy and Ozempic), and that I would be ready

“Cagrisema plays a fundamental role in the company’s future growth engine. Expectations have been high, with its share price more than doubling between 2023 and the first half of 2024,” says Jakob Westh Christensen, market analyst at the investment platform eToro. The commitment to this new drug is key in the Danish group’s strategy to distance itself from the competition again. The American Eli Lilly, with its alternatives Zepbound (for weight loss) and Mounjaro (for diabetes), also seeks to lead the new generation of anti-obesity drugs. At the moment, retatrutide, developed by Lilly, is ahead of Cagrisema.

Until now, the biggest challenge facing them, beyond their rivalry, is to supply the enormous demand for miracle drugs for weight loss. Now, this duopoly faces 40 other manufacturers working on anti-obesity alternatives such as Pfizer, AstraZeneca and Roche, among others. As more alternatives appear, current leaders will be under more pressure to make their products more effective or easier to tolerate than those of the competition, something that will become increasingly difficult.

Despite the initial panic—when Cagrisema’s results were presented the stock fell 29% in a single session—especially among retail investors who saw Novo Nordisk as a safe bet in a growing market, confidence in a good The result of the efforts is still there. For this reason, most of the recommendations of the stock exchange houses continue to be to buy shares of the company.

Side effects

“It is true that the weight loss was below the 25% expected by the market, being practically in line with Eli Lilly’s product,” comments Ana Gómez Fernández, financial analyst at Renta 4. “However, we consider that the fact “Having 2-3% more or less weight loss is not going to be so decisive in clinical practice and it is still a very nascent niche with a large unsatisfied demand,” he adds. The company has not reported specific figures. of the side effects of the new drug.

Deutsche Bank analysts agree along the same lines, highlighting that, as in any diet, the secret to success may lie in the details. “The company used a flexible dosing design that left both the maintenance dose and any decision to reduce the dosage during the trial at the discretion of the patients,” the German bank points out. Only 57% of patients reached the highest dose, which analysts believe created a “disconnect” between laboratory efficiency expectations and what actually happens in practice. This difference, JPMorgan points out, may take more than two years to be resolved, the time it takes for new studies.

Miriam Fernández, head of thematic investment at Ibercaja Gestión, points out that, although Novo Nordisk “will find it difficult to recover until it resumes a virtuous cycle of clinical study results,” we must not forget the nature of the segment in which it operates. “The idiosyncratic risk of pharmaceutical companies linked to the success or failure of their clinical trials always adds volatility, as has been the recent case of Cagrisema.”

The main analysts emphasize that, for the moment, we are only seeing the tip of the “iceberg” of the business linked to weight loss. “We are talking about a niche that could exceed 100 billion dollars in 2030 and is predictably the largest within the therapeutic areas of pharmaceutical companies,” mentions Gómez Fernández. Other analysts are even more optimistic and see a potential that reaches up to 200 billion, as in the case of the Morningstar firm.

This potential growth is added to two particularities of the Danish pharmaceutical company: its diversification and its ownership. “Obesity treatment still represents just over 20% of the company’s total sales, with the majority of revenue coming from diabetes treatment,” Christensen highlights. On the other hand, the market also highlights that the Novo Nordisk Foundation, which controls 77% of the votes and 28% of its capital, provides stability and leaves the firm less exposed to short-term rushes. At the end of the year, Lilly’s shares were valued at 34.3 times expected earnings, while Novo’s at 21.5 times, making the Danish drugmaker considerably cheaper than its US rival.

This does not mean that the threats are still present. “Since we launched Ozempic (in the United States) in 2018, our price has decreased by 40%,” acknowledged Lars Fruergaard Jørgensen, CEO of the pharmaceutical company, in an appearance before the US Senate, under pressure from the Democratic administration for the high price of medicines. However, the change of tenant in the White House does not mean the absence of problems either. “The effects of the confirmation of nominee Robert F. Kennedy Jr. as Secretary of Health and Human Services in the United States are still unknown,” Fernández acknowledges.