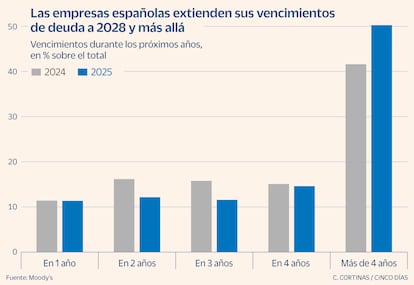

Spanish companies have managed to take advantage of the sales of interest rates and the good moment of economic growth and have taken the opportunity to lengthen the expiration of their debt and take a break for the coming years. According to the Moody’s agency, it has decreased by 2024 to 52% of the total, compared to 58% of the previous year, so that the critical moment of refinancing has been delayed from 2026-2027 to beyond the year 2028. This is this Improvement contributes to Moody’s to maintain that the credit quality of Spanish companies is better and more resistant than that of their European neighbors.

“In the last year, Spanish companies have successfully expand their debt maturities,” explains the rating agency. In addition, the percentage of companies in a good or very good liquidity position has risen to 46%,. Moody’s extracts these conclusions from the analysis of the 57 Spanish non -financial companies to which the rating assigns, including 13 infrastructure and energy companies. 67% of these 57 companies have a financial bonus financial rating, a high percentage but that Moody’s explains is in line with other European countries and that is due to the process of financial disintermediation that has allowed in the last decade that these companies, in Its majority owned by risk capital, has access to issue debt in the market.

“We hope that the credit quality of Spanish companies will continue to improve in 2025,” says the agency, which adds that this credit quality is increasing at a greater rate than is seen in the rest of the European companies. “The combination of an expansive monetary policy, lower inflation rates, the improvement of the feeling of the consumer and a solid growth, although slower, of real GDP will support the credit quality of Spanish companies in the next 12 to 18 months” , collect a report from the Moody’s agency published today.

Moody’s also points out that the credit quality of Spanish companies is probably more resistant than the whole of European companies and remembers that at the beginning of this year, 21% of Spanish companies covered by the agency have a positive perspective, which implies A possible rating improvement, while only 5% have a negative perspective. In the set of companies that Moody’s covers in Europe, in addition to the Middle East and Africa the percentages of companies that begin 2025 both with a positive and negative perspective are in both cases of 14%.

In favor of the financing and sustainability of the debt of Spanish companies will continue to play the decrease in interest rates and economic growth. Moody’s believes that and that it will close the drop cycle in the middle of the year. And forecasts a rise in Spanish GDP in 2025 of 1.8%, lower than last year, but much higher than the countries around the surroundings. Thus, for Germany this year of 0.7% and for France and Italy, of 0.9%.

In 2024, Moody’s improved the rating of 16 Spanish companies, including Merlin, Colonial, Tendam, Critia Critia, Gestamp, Masorange and Hurd The country y Five days. And made seven other rebates of the rating, among which the cuts of Grifols, Codere, Ohl and Deoleo stand out. The rating agency adds that the percentage of companies that have a weak liquidity position remained unchanged in 2024, in 14% of the total, although it is remarkably higher than other neighboring countries, such as 8% of France, the 11% of Germany or 5% of Italy.

The agency provides favorable market conditions for Spanish companies with worse credit rating thanks to type drops, although it also points out that many of them still need to refinance. Moody’s expects in any case that default of Spanish companies remain at low levels in 2025, understood the default Not as a non -payment situation but when there are changes in the initial conditions or some type of loss for the creditor. This is what happened in 2024 with Codere and OHL and what Moody’s considers very likely to happen this year with Deleo and with Naviera Armas. “In Italy that, if confirmed, would significantly weaken its financial profile. Naviera Armas has limited financial resources and could undergo another corporate restructuring in the coming months, ”explains Moody’s.