The fear of the deterioration of the US economy is causing strong losses in world bags. The latest figures that reflect a brake on job creation and a deterioration of consumption confidence, in addition to the impact of tariffs, are leading to massive sales of investors at the start of the week. Donald Trump himself has fed fears by not ruling out a recession and admitting that the country faces a “transition period” in its economy. Under this scenario, the opening of the stock market session in the US holds strong losses, and particularly in the technological sector; The Nasdaq lowers more than 3%, with falls led by the magnificent seven: Tesla leaves 8%, Apple 5%, Alphabet (Google) and NVIDIA 4%, Microsoft 3%and Amazon 2%. The S&P 500, the most representative index, of the US stock market falls 2%.

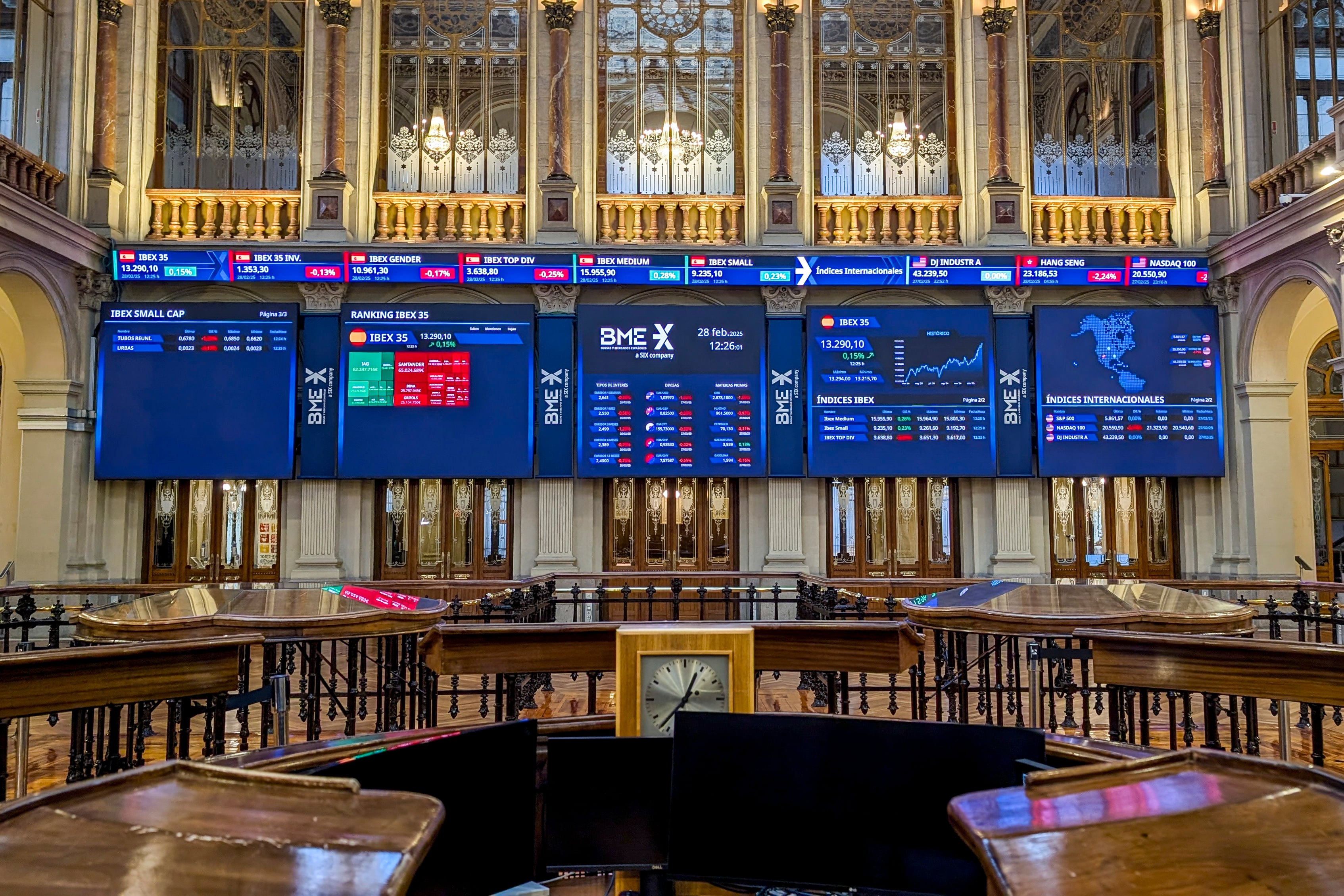

In Europe, the main indexes have also started the day with losses that have been aggravated with the opening of the United States. The IBEX is left 1.2% and is close to losing the 13,000 points. It is next to the German Dax (-1.4%) of the worst indices in the area, while the French CAC and the Italian Mib is left 0.7%. The banking sector is placed among the most harmed of the day, with Santander leaving more than 4% and Sabadell and BBVA, 3%. Acerinox and Arceormittal steel also marks, weighed down by the possibility of less economic growth. The first for the production exposed to the United States and the second for tariffs.

Beyond the fact that Trump warns of complicated times for the economy, investors are worried because the statements suggest that the president will not modify his tariff approach, not even before a scenario of a possible recession. Until now, the idea that the White House would try to avoid breaking the Wall Street streak among the experts. Analysts considered that tariffs were more a political weapon to achieve concessions in other areas. There are those who suggested that Trump used the S&P 500 as a validation thermometer of their policies. But once the threat of tariffs have been fulfilled, renowned experts, as they are notifying the risk for the economy, anticipating more volatility. Mike Wilson of Morgan Stanley expects the S&P 500 to drop 5% to 5,500 points against tariffs and the contraction of public spending.

The fall of the bags is taking the money to the usual shelters, and the yields of the public debt fall to seven points in the case of the US debt to 10 years. In Europe the descents are around the two basic points. It barely has an impact, on the contrary, on the price of the euro, which remains at $ 1,083.

What are the values that go up and more?

The values that go up the most are:

1,64%

: 3,5%

Redeia: 2.34%

The ones that go down:

-4,5%

Arcelor: -4.6%

: -4,6%

What do analysts say?

Louise Dudley, Global Variable Income Manager of Federated Hermes: “Despite the advances achieved with respect to conflicts in the Middle East and Ukraine, the positive feeling has been ephemeral and we are seeing a change in the panorama of the global variable income. With the disappearance of stock market trading of American exceptionalism, defensive sectors such as telecommunications and health, which are relatively cheap compared to other areas of the market, are sectors that are being sought by investors that want to avoid the important volatility of the market that is affecting the cyclic sectors as companies reposition themselves in the light of tariff changes. In addition, the actions that pay dividends and the value values have experienced positive flows. The worldwide diversification is key, taking into account an environment of divergent interest rates and the uncertainty faced by US companies affected by the strength of the dollar, the increase in inflation and the weakness of consumers’ trust. In general, we are seeing weaker growth perspectives due to geopolitical tensions, but there are still opportunities for companies and investors that focus on pragmatic and disciplined long -term strategies. ”

Martin Wolburg, a senior economist in Generali AM, about the ECB: “Monetary policy is now significantly less restrictive, but uncertainty is even greater. President Christine Lagarde mentioned, for example, that tariffs could be inflationary (through the depreciation of the euro) and that the effect of the tax expenditure measures announced, in case of applying, would increase the demand to an still uncertain degree. The uncertainty was even greater than before, so it reiterated the dependence of the data and the meeting approach by the ECB. Asked about whether the direction of the march was still clear, she said that a pause was now also a realistic option. In the end it will depend on the interaction between the risk of commercial war and the probable fiscal impulse. The more inflationary this combination is, the less willing the ECB will continue to cut the types. ”

What is the evolution of debt, currencies and raw materials?

He remains at $ 1,0834.

The oil, reference in Europe, falls below 70 dollars a barrel.

The 10 -year Spanish bonus performance drops to 3,494%.

– – – –