The sales wave returns to world markets with a new envy. The massive tariff plan of the president of the United States, Donald Trump including the 104% rate to China announced by the president yesterday. Trump has shaken the order in the global commercial established for decades, has exacerbated the fears of recession and has caused a historical shaking in the financial markets. After a truce day, in which the European and Asian bags took a break, the red numbers return. EURO STOXX 50 futures go back 3.5% and IBEX anticipate strong losses. In Asia, the main Asian indices fall between 2% and 4%. American futures also advance a fifth consecutive day of losses in Wall Street, with decreases around 1.5%. The dollar weakens compared to the euro and the oil drops up to $ 60 a barrel. The VIX Volatility Index, known as the Fear Index, is above 50 points, a area that corresponds to alarm levels among investors.

Trump has sent the world contradictory signals about whether the tariffs will remain in the long term – they have defined as “permanent” – since he has also presumed negotiations with Japan and other countries – more than 50 governments have requested them, as they have leaked. “Many countries are coming, they want to reach agreements,” said the president at an event at the White House on Tuesday afternoon. Investors put their hopes in these alleged negotiations and the bags of Europe and Asia closed the session on Tuesday calm. However, the announcement of a new punishment to China gave the good tone and Wall Street turned down. Trump said and approved the decree that also triples import rates to platforms such as Temu and Shein from China. The American indices, which were scored, lost to the close around 1%.

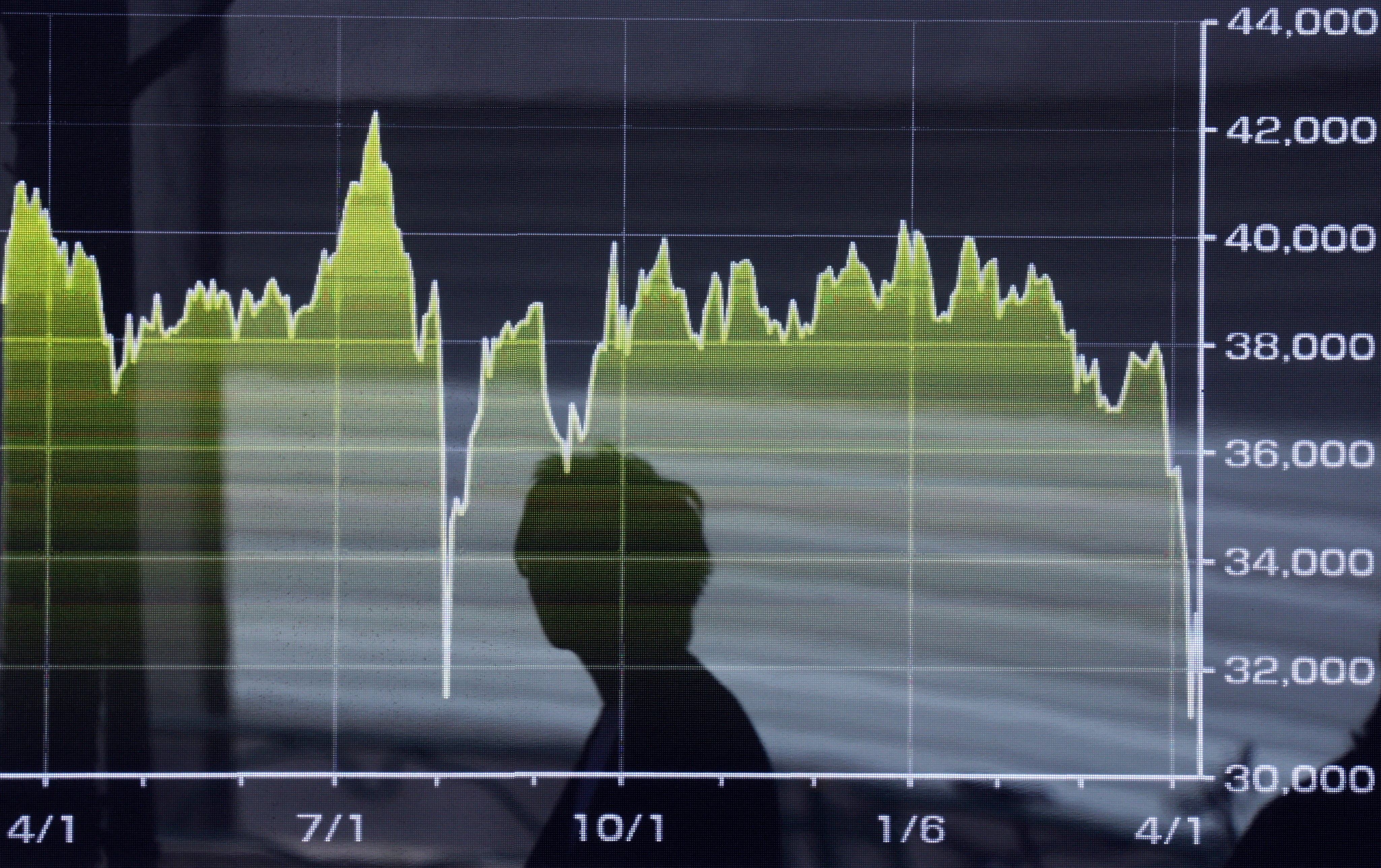

After Tuesday’s respite, Japan’s Nikkei today falls more than 4% and accumulates 12% losses in a week, from the announcement of the tariff plan. Hong Kong Hang Seng is left 2% today and Korean Kospi, 1.6%. The Shanghai composed index dodges the descents and rises 0.2%, after 10 of the main Chinese stock market houses committed to help stabilize the prices of the actions, in a concerted effort, said Shanghai’s bag. Among the participants are Citic Securities, Orient Securities and Industrial Securities.

The S&P 500 has lost almost 6 billion capitalization since Trump announced the taxes a week ago, the largest loss in four days since the creation of the index in the 1950s, according to Reuters data. The S&P 500 is now approaching a bearish market, defined as 20% below its maximum. The index is now below 5,000 points, 19% below 6,144 points it marked in mid -February.

The storm also reaches currencies. The dollar falls by 1% against the European currency and each euro costs $ 1,105. The Yen and the Swiss Franco, coins that have become a refuge against turbulence, continue to reinforce themselves against the dollar.

In raw material markets, tariff barrage makes a dent in oil, and the price of Brent barrel, reference in Europe, 4% fall and are around 60 dollars. The future West Texas Intermediate of the United States lose more than 4% to $ 56.92 a barrel.

The gold, meanwhile, takes up the increases: the ounce adds 1.4% and reaches $ 3,033, even below the $ 3,100 that marked maximum at the end of last week.

Given the extraordinary uncertainty caused by the tariff barrage, analysts do not dare to estimate the impact of new levies on economies. “It is impossible to reasonably estimate the impact of the current commercial war between the United States and China,” says a Nomura report.

– – – –