Investors continue to lose confidence in the dollar. The American currency has marked on Monday its lowest level compared to the euro since November 2021, with a change of $ 1.15 for each euro at the beginning of the operations of the currency market. The new drop in the dollar occurs to the one who suggested that he could say goodbye if he wanted, although the law theoretically prevents it.

It rains on wet, both in regards to Trump’s threats to the independence of the Federal Reserve and the loss of confidence in the US currency following the commercial war declared against the world by the president. Most world markets closed on Friday by festive and part of them are still closed on Monday, so that the activity is lower than usual.

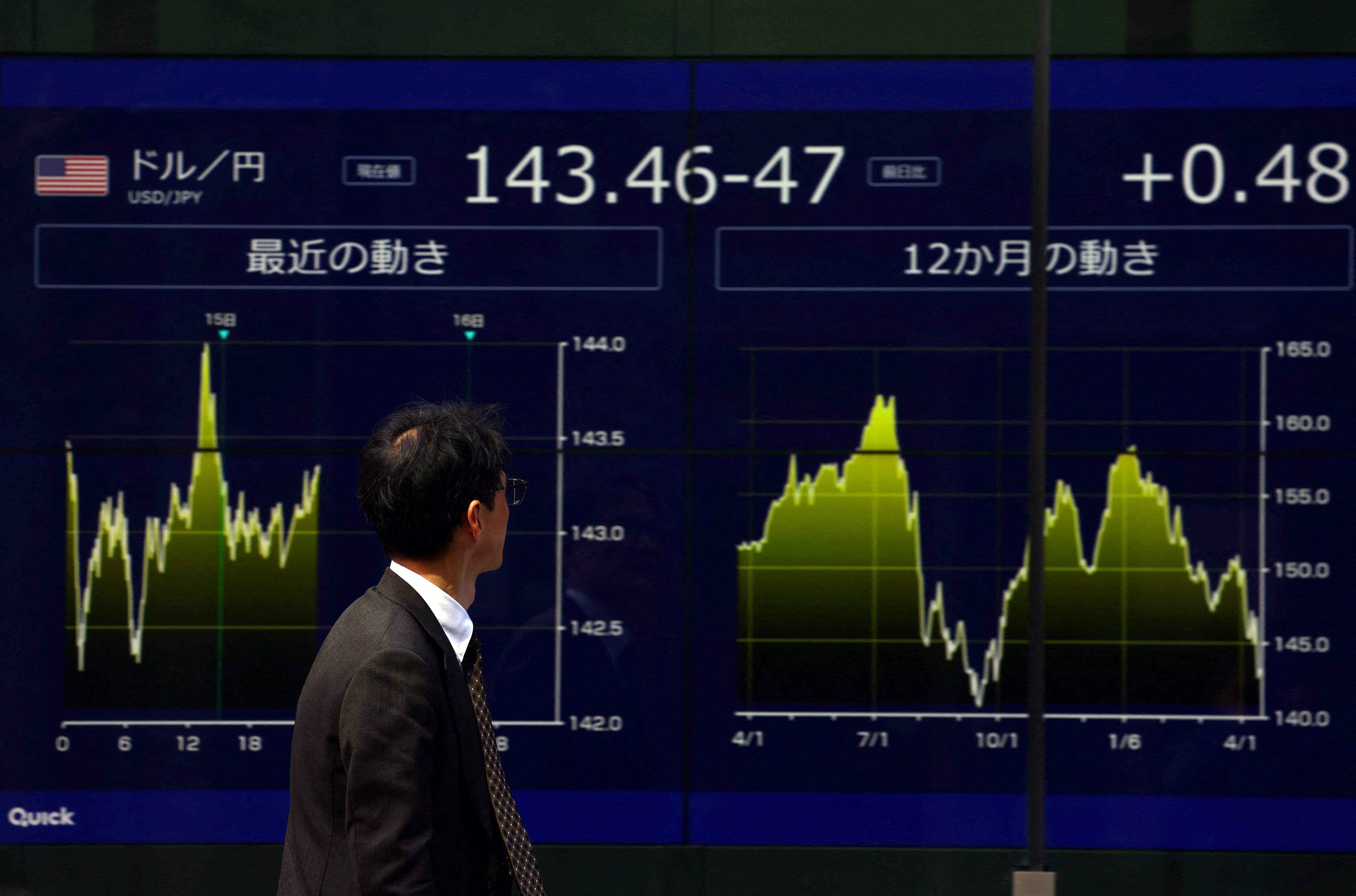

The dollar marked on Monday at the opening of the Asian markets its lowest level in a decade against the Swiss Franco, at 0.80695 dollars per Swiss Franco, and slid to its weakest level compared to Yen in seven months (140.63 yen per dollar), while the euro rose to $ 1,153, its maximum since November 2021, in the midst of the crisis of confidence in the dollar.

Kevin Hasett, director of the National Economic Council of the White House, declared Friday that the president and his team continued to study the possibility of dismissing the president of the Federal Reserve, Jerome Powell, only one day after the time he asked the Central Bank to cut the interest rates.

The same Thursday, “I don’t think his job is doing well. He is always late, it’s slow, and I’m not happy with him. I have told him, and if I want him to leave, he will leave very fast, believe me,” he said.

“Powell does not depend directly on Trump, so he cannot say goodbye. It can only be dismissed through certain procedures that one would think they have a greater obstacle … but can the president move the gears to undermine the perceived independence of the Fed? Of course he could Reuters “I would say that they do not even need to say goodbye to Powell. You just have to create the perception that the vision of an independent Fed could be changed,” he added.

Powell’s mandate as president of the Federal Reserve expires on May 15, 2026 and as a counselor, on January 31, 2028. On previous occasions, Trump has indicated that he does not plan to dismiss him in advance. The Secretary of the Treasury, Scott Besent, has expressly supported the independence of the Central Bank in setting interest rates. And his mandate was in his first mandate, Trump already made him an scapegoat while undertaking his first commercial war, in 2019.

Persistent weakness

Goldman Sachs analysts radically changed their opinion on the dollar recently after observing the evolution of recent weeks and reconsidering the possible implications of changes in the economic and commercial policy of the United States. “Now we hope that the recent weakness of the dollar persists,” they said.

“In the first place, the combination of an unnecessary commercial war and other policies that increase uncertainty is seriously eroding the confidence of consumers and companies. Secondly, negative tendencies in governance and institutions of the United States are eroding the attraction of US assets for foreign investors. Thirdly, simplistic calculations and constant outbreak of high uncertainty, ”they summed up.

Initially, analysts expected tariffs imposed by the United States to cause a exchange rate to adjust the exchange ratio. However, the changing nature of tariffs may have modified, according to Goldman, the paradigm to determine the impact. “Tariffs on less substitutable goods give foreign exporters a greater price setting power. It is possible that general tariffs have a similar effect: US companies and consumers become price makers, and it is the dollar that must be weakened to adjust if supply chains and/or consumers are relatively uninlastic in the short term,” they explained.

His previous thesis was that the exceptional profitability prospects in the United States were responsible for the strong valuation of the dollar. However, “if the tariffs wear the benefit margins of US companies and the real income of US consumers, they can erode that exceptionalism and, in turn, cracking the central pillar of the strong dollar,” they added.