The markets do not rest even on holidays, especially with Donald Trump in the Oval Office. This Monday, with a large part of the closed world bags (including European), US indices accelerate falls to about 3% injured by the pressure from the White House on the Central Bank, started last week with Trump claiming Powell’s dismissal, has been increasing. In a new chapter, the president of the United States has described Powell as “loser” and claimed “preventive cuts” in interest rates. “There may be a deceleration of the economy, unless the Lord too late, a great loser, goes down the rates now,” he said.

The reaction in the main Wall Street indices has been immediate. If the futures market already pointed to a downward session with 1%drops, sales have accelerated as the session advanced (and institutional tension). In the afternoon, Nasdaq loses more than 3%, S&P 500 2.8%and Dow Jones 2.7%. It is the greatest fall since April 10. while long -term treasure bonds also suffer pressure. The profitability of the 10 -year paper has triggered 4.38%, compared to 4% of April 2, the date of the new tariff offensive. When the yield rises, it means that the value of the bonus has dropped because investors demand more profitability. The situation of continuous conflict that the United States has caused has caused the mass sale of US assets. Gold, traditional active shelter, has first exceeded in history the $ 3,400, with a 25% revaluation so far this year. The Swiss Franco and the Japanese Yen have also strengthened against the dollar.

This new fire caused by Trump revives concern among investors for the US market, in this case for the independence of the Fed, one of the cornerstones of financial stability. The credibility of the Federal Reserve as the most powerful Central Bank in the world is largely based on its historic independence to act without political influence. “While monetary policy is a relatively overwhelming weapon, it is used to control inflation in the medium term. This depends on the confidence in the Central Bank,” says Reuters Paul Donovan, chief economist of the UBS Global Wealth Management manager. “Building that trust has been for years. Losing it can happen overnight,” he concludes.

Although the possibility that Trump dismisses Powell is weighing in the markets, it is a very complex maneuver. A president cannot easily dismiss a head of the Federal Reserve, according to the legal experts consulted by Bloomberg. Article 10 of the Federal Reserve Law stipulates that the members of the Board of Governors, of which the President is part of the President, can be “dismissed for the cause justified by the President” and the analysts interpret “cause” as a serious misconduct or abuse of power. “The independence of the Central Bank is very valuable; it is not something that can be taken for granted and is very difficult to recover if it is ever lost,” says Bloomberg Will Compernolle, Macroeconomic Strata of FHN Financial. “The threats against Powell are not contributing to the confidence of foreign investors in US assets, but I still believe that tariff updates are the main factor,” he adds.

Tariff war

To this institutional uncertainty is added commercial tension. Negotiations between the US and Japan are still stagnant, which reinforces the forecast of a long process until at least July. “The failure to move towards an agreement suggests a prolonged period of negotiation,” said Thierry Wizman, from Macquarie. In this environment, investors take refuge in safe assets. Gold has first exceeded $ 3,400 per ounce, with a 25% revaluation so far this year. Javier Molina, Etoro market analyst, points out that “the bags are not preparing to bounce, they are struggling not to break.” After the Holy Week stop, the markets “leave a disturbing feeling where they do not collapse, but they do not bounce. They move without clear direction, in an environment of high volatility, low liquidity and an increasingly deteriorated investment feeling. It is a scenario where nothing ends up breaking, but everything seems to do it,” he adds.

In addition, investors are attentive to the start of the US results season. This week, the focus will focus on Alphabet accounts (Google owner), the Intel chips manufacturer and the Tesla electric vehicle group. Elon Musk’s group falls more than 7% after cutting the Barclays investment bank its recommendation on action against the “confusing” visibility of the results of the first quarter. Apple also drops more than 3% while Netflix, which presented its accounts last week, rises 2%.

“The markets are already nervous due to the escalation of geopolitical tensions, and now increases the concern that Trump’s possible interference with the Federal Reserve can add another layer of uncertainty,” says Charu Chanana, Strategist Head of Investments of Saxo Bank. For their part, from the Vital Analysis firm Knowledge considers that the threat on the Fed “is related to Trump’s commercial war, since Powell is forced to stay out of the sidelines for the perspective of an rebound in inflation in the coming months, induced by tariffs. And all this, despite market volatility and increased growth risks”.

Festive in European stock markets

The Spanish and European markets will resume their usual operations tomorrow, Tuesday, April 22. He ended on Thursday of last week with a 0.19% decrease until up to 12,918 points. The Spanish selective accumulates an annual increase of 11.41%. The Spanish stock markets and debt markets have this year with six holidays, the same as in 2024. The Spanish Stock Exchange has already closed on January 1. Likewise, it will be holiday on May 1 (Labor Day), December 25 (Christmas) and Friday, December 26. On Wednesday, December 24 and Wednesday, December 31, the market will remain open until 2 pm.

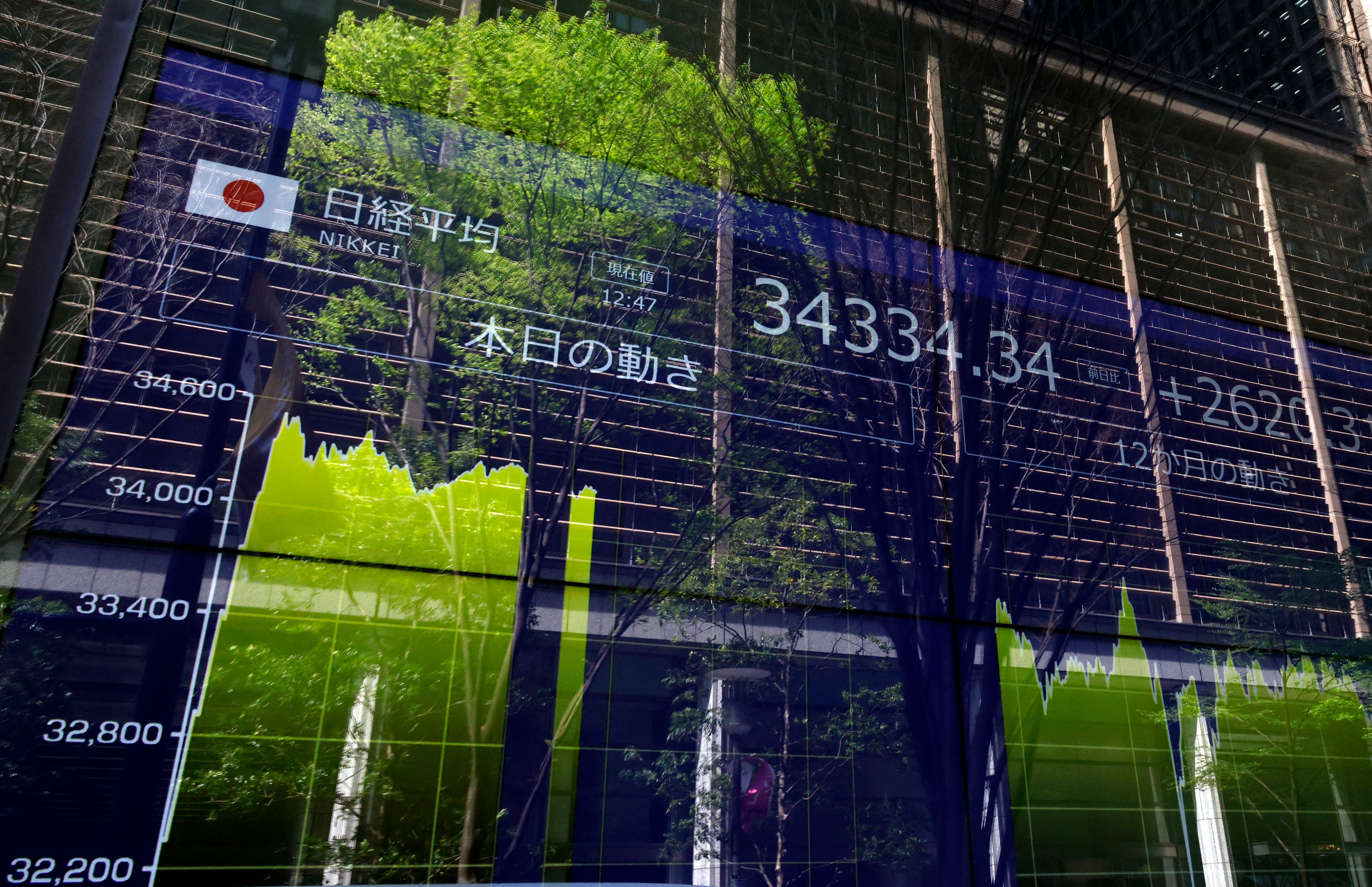

In Asia, the bags have closed with disparate results in a session with a small volume of holidays for holidays. The stock markets of Australia, New Zealand and Hong Kong have been closed. The Chinese indices rose slightly, while the Nikkei of the Tokyo bag fell 1.30%, largely due to the strength of the Yen against the dollar. This fortress coincides with the visit of the Minister of Japanese Finance, Katsuyuki Kato, to the USA in order to meet with the Treasury Secretary, Scott Besent, with which he is expected to treat currency issues.

In a new episode of commercial tensions, but to any country that negotiates commercial privileges with Washington that can harm their interests. According to various US media, Trump plans to use the current tariff conversations to press China’s business partners to limit their relations with the Asian country. Beijing has issued a statement in which it warns that if that situation occurs, “it will take countermeasures with determination and reciprocally.”

In Spain, on Thursday the Bankinter figures will be known, which will give the starting gun to the presentations of the first quarter. Although in the accounts of the companies until March they will not collect the impact of the uncertainty of the tariffs (the bulk of the encumbrances was announced in early April), they can give an idea of the business situation prior to the commercial storm.

Among macroeconomic data, on Monday it has been known that the Japan CPI that increased as expected in March, while the underlying inflation accelerated due to a persistent increase in food prices, complicating the type prospects of the Bank of Japan (BOJ) in the midst of tariff tensions with the US Underlying, which excludes fresh food prices, increased 3.2% year -on -year.

For its part, the Popular Bank of China maintained its preferential rate of reference loans on Monday, complying with market expectations, which indicates Beijing’s preference to boost economic growth through fiscal measures instead of additional monetary flexibility. The PBOC left its LPR to a year at 3.1%, while the five -year LPR rate, which is used to establish mortgage rates, remained at 3.6%. Both rates are in historical minimums, after a series of cuts during the last three years.

– – – –