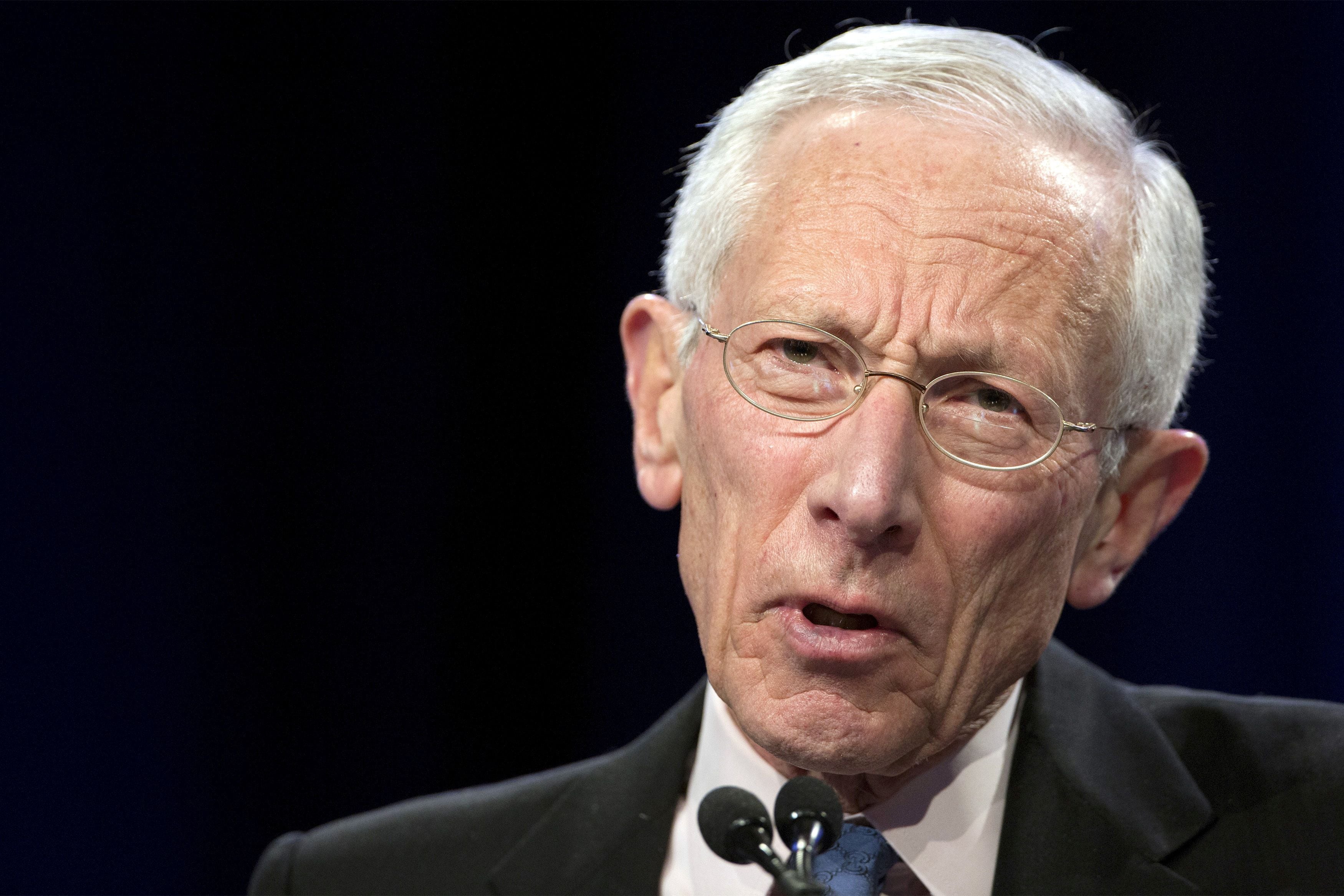

Stanley Fischer died this Saturday at age 81, according to the Bank of Israel. Fischer had a double race. As an academic, he trained generations of economists both in their classes of the University of Chicago and the Massachusetts Institute (MIT) and through their books, especially its 1978 manual Macroeconomy, who wrote with his colleague Rudi Dornbusch. As political responsible, he occupied among others the positions of number two of the International Monetary Fund (IMF), governor of the Bank of Israel and

He directed the doctoral thesis of Ben Bernanke, who would later become president of the Federal Reserve and considered Fischer his mentor. He also had among his students at Mario Draghi, future president of the European Central Bank and Prime Minister of Italy; Lawrence Summers, who held the position of Secretary of the United States Treasury with Bill Clinton as president; Greg Mankiw, who directed the Council of Economic Advisors of President George W. Bush; Kazuo Ueda, appointed governor of the Bank of Japan in 2023, and two chief economists of the IMF, Olivier Blanchard and Maurice Obstfeld.

“Stan was my mentor and my friend. He was an exceptional economist, an outstanding politic own research, their students and their political decisions, in the macroeconomic policy of the whole world. ”

Fischer was born in Lusaka, Zambia, in October 1943, within a community of Baltic origin that had emigrated to southern Africa. He obtained his degree and his master’s degree in the Economics at the London School of Economics. In 1969, he was a doctorate in economics from the Massachusetts Institute.

He was professor of Economy at MIT from 1977 to 1999 and associated professor from 1973 to 1977. Before joining the MIT teaching staff, he was an attached professor of economy and postdoctoral fellow at the University of Chicago. In parallel, from January 1988 to August 1990, he held the position of the first deputy manager of the International Monetary Fund since September 1994 number two by Michel Camdessus in the IMF, in Mexico, Russia, Brazil, Thailand, Indonesia and South Korea. When leaving the international agency, he was vice president of Citigroup from February 2002 to April 2005.

He had dual American and Israeli nationality since in 2005 he was appointed governor of the Bank of Israel, a position he held until 2013. The Central Bank of Israel was the first to cut interest rates in 2008, at the beginning of the world economic crisis, and the first to upload them the following year in response to the signs of financial recovery. Decades before he was part of the team of economists who developed the stabilization plan that faced the economic crisis in Israel in 1985 and served to overcome a prolonged period of weak growth, three -digit inflation and fall in foreign exchange reserves.

“Professor Fischer had a great impact on Israel’s economy, both during the 1980s, when he was a representative of the International Monetary Fund in Israel and played a key role in the elaboration of the 1985 economic stabilization plan, as later, during his mandate as governor, when he directed a responsible economic policy for a difficult period, including the world financial crisis of 2008,”

Fischer after the resignation of Dominique Strauss-Kahn. “An extraordinary and not planned opportunity has emerged, perhaps the only one that will be, and I have made the decision after reflecting a lot,” there were two obstacles to it: with 67 years, it exceeded the age limit of 65 years that was required and, in addition, the position is traditionally reserved for a European. The chosen was Christine Lagarde.

After leaving the Bank of Israel, Fischer was appointed by Barack Obama in 2014 Vice President of the Federal Reserve. During his term, he held the position of president of the Financial Stability Committee and the Monitoring and Financial Research Committee. It represented the FED in the Financial Stability Council, the Bank of International Payments, the G20, the G7, the IMF and the Organization for Economic Cooperation and Development (OECD).

although in 2019 he accepted a role as Blackrock advisor. “Stan’s acute perceptions, based on a lifetime of exemplary academic work and public service, have contributed invalibly to our deliberations on monetary policy. It has represented the Council with international distinction and has led our efforts to promote financial stability,” said the then president of the Fed Janet Yellen,