More than 570 thousand Individual Microentrepreneurs (MEIs) they were unbeaten In 2024 because they exceed the gross revenue limit allowed for the category ,. The data, raised by Accounting based on information from FederalIt shows that this kind of situation jumped almost 30 times compared to 2023.

According to Guilherme Soares, Executive Vice President of Operations of Contabilizei, exceeding the ceiling can be seen as a sign of progress. “Usually, when one for excess gross revenue, by choice or automatically by the IRS, this indicates that the business is growing,” he says.

Cases where revenues exceeds the limit by up to 20%, the entrepreneur must pay a complementary tax and undertake the following year. If the excess is higher than this percentage (being over R $ 97.2 thousand), the non -compliance should be immediate and retroactive to the beginning of the fiscal year, except for companies open in the same year, which must adjust from the opening date.

Organize your financial life with AI

And there is no way to escape revenue, as inspection systems are increasingly accurate, with crossing information and data from the regulatory agencies, such as and expenses on credit card. This has helped to expand the number of non -compliances made automatically, but occurs without notice to the entrepreneur – which can generate headaches, bureaucracy and costs.

Other reasons for exclusion

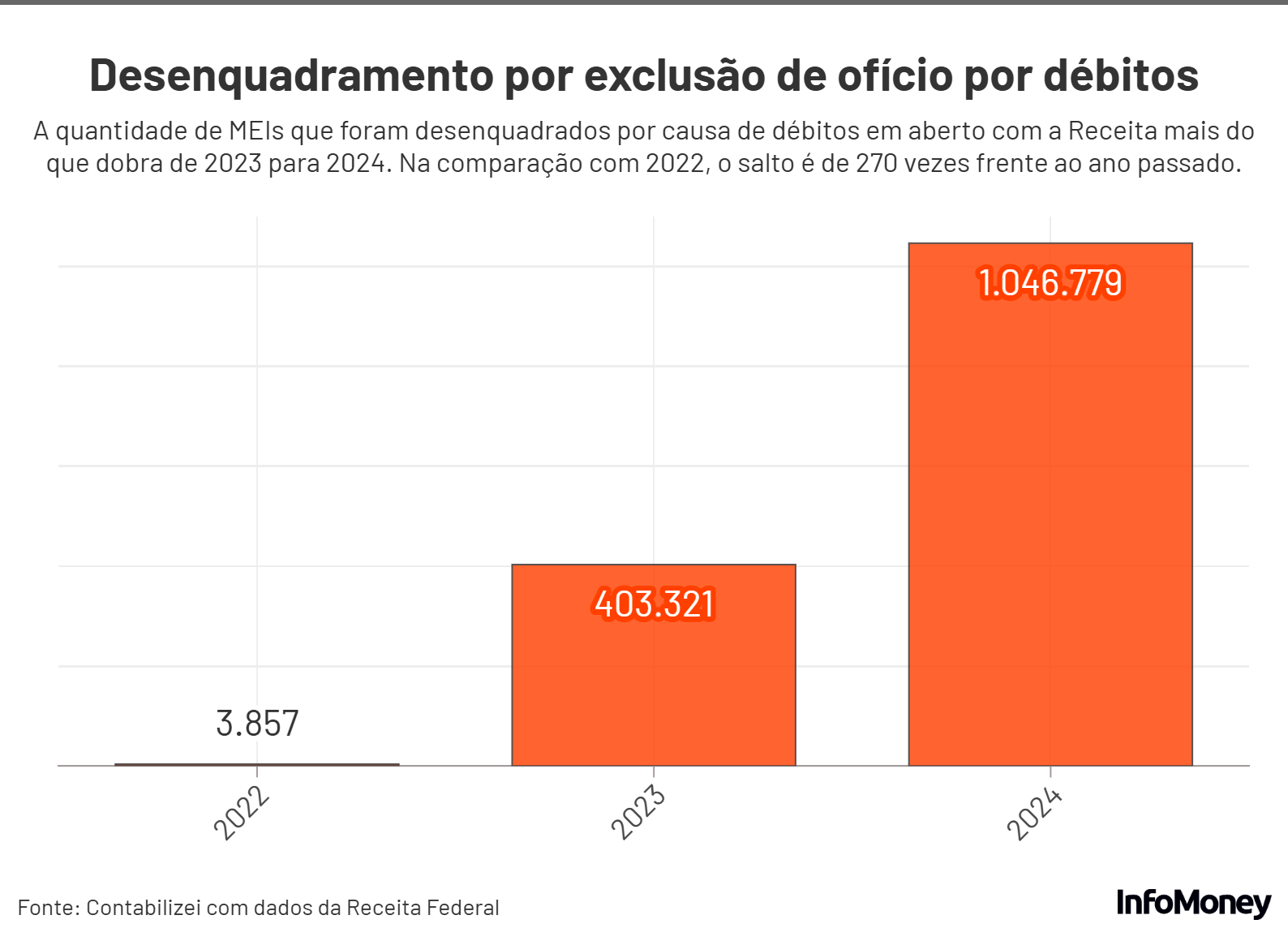

The loss of MEI condition can also occur by. More than 1 million CNPJs were excluded from the category by debts with the tax authorities. The historical comparison shows a significant increase: more than double compared to 2023 and a 270 -time jump compared to 2022 (See details on the chart below).

Soares recalls that in these cases it is still possible to maintain the same CNPJ and preserve bank accounts, contracts and health plans. For this, the company must regularize its fiscal situation in, which may include fines and interest.

Continues after advertising

Given these situations, the ideal is for the entrepreneur to seek specialized guidance as soon as possible. “It’s bad to be undertaken automatically, because there is no time to organize properly,” warns the executive. He adds that when anticipating, the MEI can reduce costs and avoid more complex setbacks in this transition process.

MEIS HIGH AND LIMIT WITHOUT UPDATE

Despite these numbers, the number of Brazilians who decide continues to grow. In the first quarter of 2025, more than 1.4 million companies were opened, 77% of them in the individual microentrepreneur mode.

This represents an increase of 37% compared to January, February and March 2024. Already in relation to the historical series for the same period of the last decade, the average annual growth observed was 12% in the openings of MEIs, with an accumulated high of over 181% in the period.

Continues after advertising

Regarding the billing limit for microentrepreneurs, the last update occurred in 2018, with a. Since then, the value has not been updated following accumulated inflation, resulting in a lag that impacts microentrepreneurs.

However, there are currently complementary bills to be processed on the subject. It proposes to raise annual revenues to R $ 130 thousand. Already the search for automatic adjustments based on the National Consumer Price Index (IPCA, official indicator of Brazilian inflation), and the one, which encompasses all proposals.