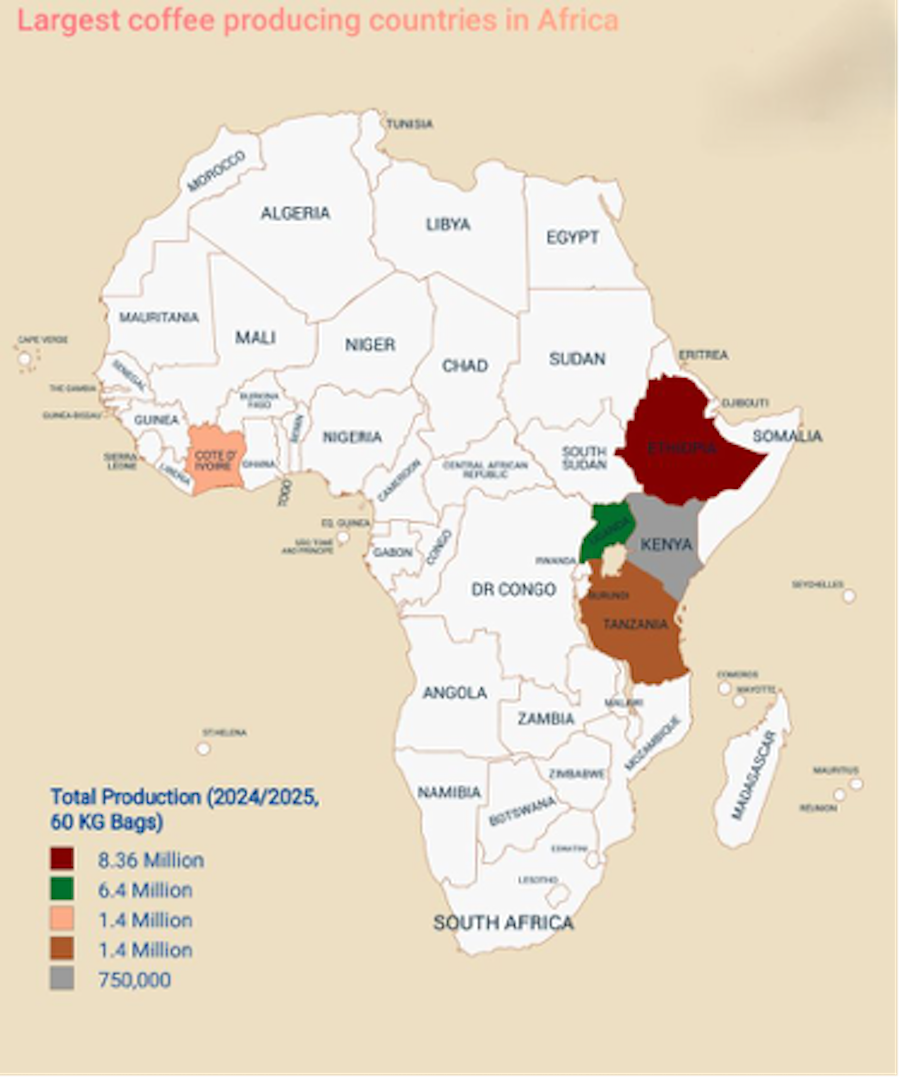

Africa, home to some of the world’s richest coffee varieties, faces a significant economic paradox: despite contributing almost 12% of global production, the continent captures only a small fraction of the real value of its harvest. Much of its coffee is exported as raw, unprocessed beans, which causes Africa to lose out on the substantial profits from roasting, branding and retail, stages dominated by companies in Europe, the US and Asia

The value chain paradox

The disparity is stark. A kilogram of green beans sells for US$3-4, but, roasted and packaged, it can fetch US$20-30 in consumer markets. When this same coffee is served in cafes, the value of a kilo can exceed US$200. The difference is not in the bean itself, but in the added value through processing, branding and storytelling. Coffee is more than agriculture: it is an industrialization business, branding and global positioning.

For Africa, the solution lies in a paradigm shift. Instead of acting as a mere supplier of commoditiesthe continent needs to become a creator of global coffee experiences. This can be achieved by investing in local roasting and packaging centers, developing brands that value origin and traceability, and using e-commerce to sell directly to consumers. Furthermore, growing domestic consumption in African cities can create resilient markets, reducing dependence on exports. The next Starbucks, Nespresso or Blue Bottle Coffee could very well emerge from Nairobi, Addis Ababa

Financial opportunities and the connection with coffee

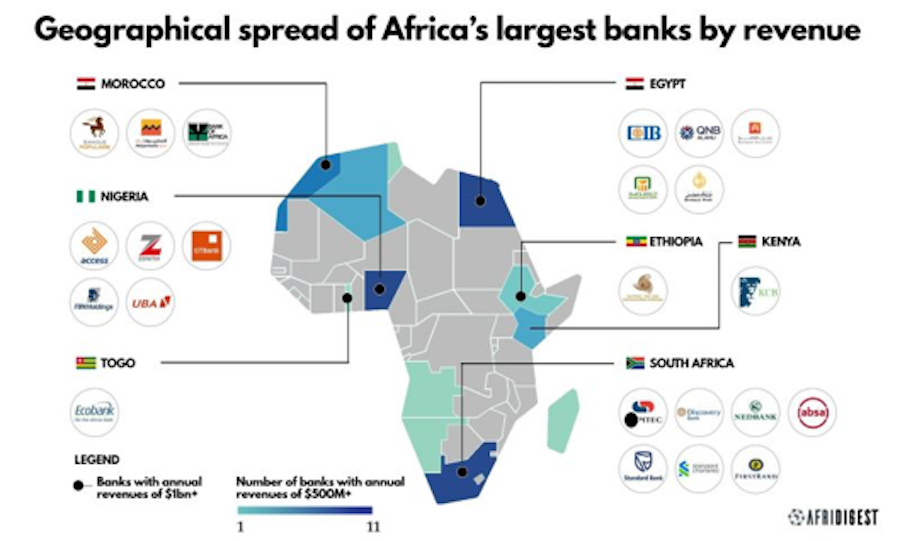

Africa’s ability to retain more value from coffee is intrinsically linked to its ability to mobilize capital and develop financial infrastructure. THE african banking map reveals where the main centers of financial power are concentrated. Countries such as South Africa, Nigeria, Egypt and Morocco dominate the banking landscape, home to banks that act as anchors for the continent.

However, there are regional champions such as Ecobank (Togo) and KCB (Kenya), which prove that financial leadership is not restricted to the largest economies. This diversity is crucial for the future, as the next decade of the African banking sector will be defined not only by the growth of the largest banks, but also by their ability to capture untapped markets and integrate into the African single market. African Continental Free Trade Area (AfCFTA).

The connection between finance and coffee is clear: the expansion of roasting centers, the development of brands and the growth of e-commerce require investments and robust financial solutions. A diversified and accessible banking ecosystem can finance small and medium-sized producers, support branding and facilitate digital transactions, boosting the coffee value chain from the inside out.

Portugal’s role

In this scenario, Portugal can act as a central actor. With a long history of trade and a strategic geographic position, the country can become a crucial bridge between African production and the European market.

- Strategic Partnership: Portugal can establish partnerships with African countries to invest in roasting and packaging technology, transferring know-how and capital to create value at source. This not only benefits African economies, but also creates a higher value supply of coffee for the Portuguese and European markets.

- Branding and Distribution: Portugal’s experience in branding and its distribution network can be used to help African coffee brands enter the European market. Instead of importing raw beans, Portuguese companies can partner with African brands, promoting coffees that tell a story of sustainability, heritage and quality.

- Financial Innovation: As a hub for financial and technological innovation, Portugal can collaborate with banks and fintechs African companies to develop solutions that facilitate digital trade, microfinance for small farmers and the integration of producers into the global economy.

By aligning its interests with the added value potential of African coffee, Portugal can go beyond being just an importer, becoming a strategic partner in economic development. The question is not whether Africa can produce world-class coffee – it already does. The real opportunity, for both Africa and Portugal, is to capture and share the full value of these grains.

Editing and adaptation with AI by João Palmeiro with .

Also read: