Investors hold their breath at any blink from Nvidia, the microprocessor manufacturer that has become the largest company in the world thanks to . The company born in Santa Clara (California) in 1993 has presented this Wednesday its results corresponding to the third quarter of its fiscal year in the midst of the growth due to the excessive billion-dollar investments and the conspicuous circular relationships between a handful of companies in the sector.

has recorded profits of 31.91 billion dollars, the equivalent of about 27.6 billion euros, during the third quarter of its fiscal year, which includes the period between August and October. This figure represents an increase of 65% compared to the same period last year.

The improvement is 59% in the accounting that the company does to exclude the expenses for share-based compensation, the costs related to acquisitions, the results for unlisted and stock market variable income securities, the interest expenses related to the amortization of the debt discount and the tax impact associated with these concepts.

They rose 2.85% during the day to $186.5 per share. In post-closing operations it appreciated 4.5% and analysts expect it to rise even more as all operations are formalized.

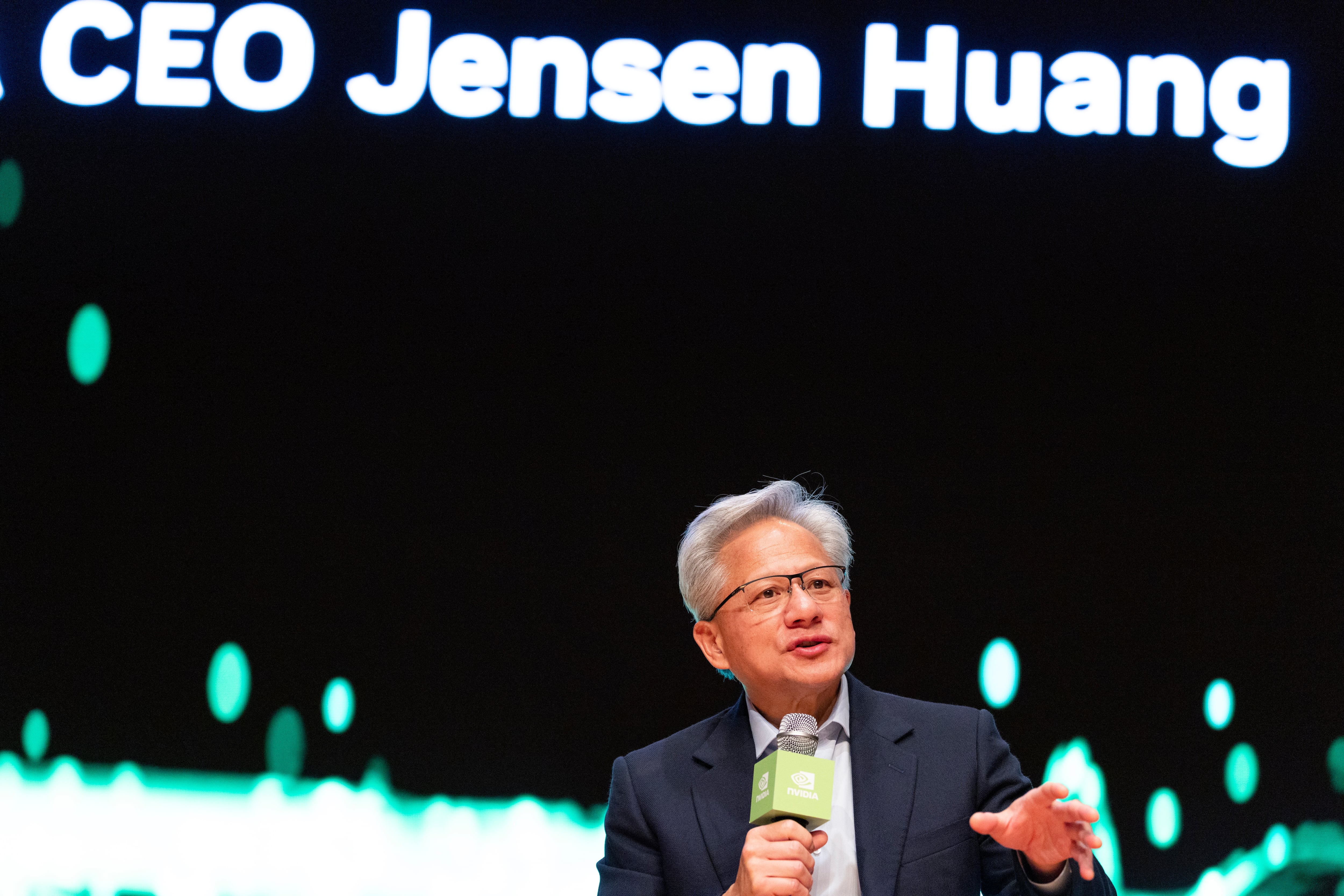

“Computing demand continues to accelerate and multiply in both training and inference, growing exponentially in both cases. We have entered the virtuous circle of AI. The AI ecosystem is scaling rapidly, with more creators of basic models, more startups of AI, in more sectors and in more countries. “AI is present everywhere, doing everything, simultaneously,” said CEO Jensen Huang in a statement.

Various evidence confirms the Huang assured a few weeks ago that demand for AI chips was “exceptionally strong.” The executive also specified that the technology group expected to reach revenues of more than $500 billion by 2026. Last month, CC Wei, CEO of TSMC, the main chip maker for envy, assured analysts that demand for AI remains “very strong,” even better than expected three months ago.

The results exceed investors’ expectations. Analysts expected Nvidia to post more than 50% growth in both its net income and sales during the fiscal third quarter. This select group of large technology companies plans to increase their combined investment in AI by 34% in the next 12 months, reaching $440 billion, according to data compiled by Bloomberg.

Nvidia has reported sales of $57 billion, which represents an increase of 62% compared to the turnover obtained a year ago.

The CEO of Nvidia, due to the importance of its chips, which have become the object of diplomatic negotiations. In fact, he was one of the guests at the dinner that the American president offered on Tuesday to entertain the crown prince of Saudi Arabia, Mohammed Bin Salmán. Also present at the luxurious celebration were the founder of Tesla, Elon Musk; Apple’s chief executive, Tim Cook; AMD President Lisa Su; and the footballer Cristano Ronaldo, among others.

Few companies represent the rise of artificial intelligence better than Nvidia and OpenAI. The company founded by Jenseng Huang is a pioneer in the manufacture of the most advanced microprocessors, which offer great computing power and are, therefore, necessary for the development of AI. All companies that want to be at the forefront of the business need their chips, which have become coveted pieces of technology.

The Californian company has a systemic rating. Its capitalization represents 8% of the value of the entire S&P. Its fluctuations in the stock market not only affect stock market investors, it also impacts the savings of pensioners or the investments of millions of families.

“This is a typical ‘if Nvidia does well, the market does well’ report,” Scott Martin, chief investment officer at Kingsview Wealth Management, told Bloomberg.

Analysts hope Nvidia’s results will help allay concerns about an AI bubble. Some doubts fueled after the disappointing results of Palantir, the company that uses AI for data analysis that it exploits through Defense contracts. The Oracle situation has not helped to clear up the uncertainty on Wall Street either. The company led by octogenarian Larry Ellison has lost 30% of its value since October due to doubts about whether it will be able to make profitable the overwhelming investments of tens of billions that it has announced that it will allocate to AI.

Nvidia had accumulated a drop of 12.4% since at the end of October it achieved the milestone of becoming the first company in the world to exceed a valuation of five trillion dollars.

The presentation of results occurs the same week that Nvidia announced an agreement with Microsoft to invest up to $10 billion in the AI development company Anthropic, founded by former OpenAI employees. At the same time, Anthropic will acquire $30 billion in computing capacity from Microsoft Azure. Additionally, Nvidia and Anthropic will collaborate on chip design and engineering. Further evidence of the complex circular relationships in the sector is Nvidia’s $6.6 billion investment in OpenAI announced last October. It also does business with Tesla’s technology subsidiary, xAI. The Californian group will contribute another $100 billion to OpenAI, the company at the forefront of generative AI models. This company, founded by Sam Altman, reached a similar agreement with AMD, Nvidia’s rival, evidencing the murky relationships maintained by the dozen companies in the sector.

The same day that Nvidia presented results, the Brookfield investment fund announced a plan to raise more than $100 billion for investments in AI. The fund manager launches the program in collaboration with the Kuwait Investment Authority (KIA), the emirate’s sovereign wealth fund, and the participation of the microprocessor manufacturer.